By Dimitrios Koutsoumpos

By Dimitrios Koutsoumpos

Often, in my posts, I have talked about the concept of cyclicals, and the idea of buying them when the conditions are super depressive. Hence, I can’t remember myself buying any of these stocks while operating in good conditions, and producing lofty earnings. Gulf Keystone Petroleum (GKP) seems to be an exception to this rule, for reasons that I will explain in this article.

The oil price is high ($110 per barrel), so the company indeed operates in favourable conditions. As a low-cost producer, the margins are lofty, and Gulf Keystone is expected to report $170 million in profits in FY 2021, most of them coming in the second half of the year. FY 2022 will be even better according to the analysts, with the EPS consensus at $1.15, which translates to $245 million of net income. Those projections seem reasonable if the oil price stays at current levels. The company at 223p ($2.92*) trades for $624 million, leading to a forward P/E (2022) of 2.5x!

I doubt that this level of profitability is sustainable, but 1/3 of it, or so, could be. As always in cyclicals, I prefer to smooth the earnings to what I think is on average achievable, so that I can approach the earnings power of the company. My rough idea is that this should be somewhere around $80 million. Again, the stock trades only about 8x times this amount, calculated in a way not affected by the cycles, and showing that the stock is cheap regardless of the effect of the favourable conditions. This explains why I make the exception to buy it in the “sunny days”.

* The company trades in pounds (£), but the reporting currency is the US dollar ($).

It is outstanding that Gulf Keystone choses to distribute the increased amount of cash flows it generates. In the past eight months, the company has distributed $150 million, which is almost ¼ of the market capitalization. If the company keeps distributing most of its earnings, and energy stays hot for a while, the dividend yield could surpass 25% at the current stock price.

Gulf Keystone’s Profile

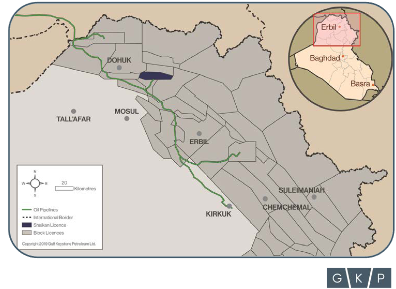

So far you read about numbers, and I have told you nothing about the company. I confess I feared that some of you would instantly escape to another tab, if I initially revealed to you that the company operates in Iraqi Kurdistan. This autonomous area of Iraq, is de facto controlled by KRG and its peshmerga fighters, and seeking independence, which poses a significant geopolitical risk for the company’s operations.

Source: Company’s Presentation

On the other hand, the Kurdistan Region is stable for the moment, and economically liberal. In addition, Gulf Keystone is incorporated in the Barmudas (a British Overseas Territory), and trades on the London Stock Exchange. Thus, in terms of ownership, corporate, regulatory, and accounting standards, the company is pretty British.

Gulf Keystone extracts oil from Shaikan, a giant oil field. The company says that the gross Opex per barrel target is at $2.50 – $2.90, and that the low depth demands little investment for expansion, while there is room for growth.

The big prospect here is the elevated energy prices to persist for a while, something that would expand the company’s production and size with some retaining of the earnings. So, even if prices naturally move somewhere lower later in the future, the increased volume will allow the company to sustain a higher profitability compared to its historical average. My biggest fear is related to the region in which the company operates, and the possibility of Kurds losing control of the lands.

Exit Strategy

In stories with diverse expected outcomes and uncertainty, forming an exit strategy is challenging. Buying for cheap is not a problem, but since you take significant geopolitical, and commodity price risk, you aim to get the most you can out of the investment. You don’t want to lose your money in the bad scenario (recession, KRG collapse, etc), while earning just a 2x in the good scenario, if you could have got a 5x.

So, yes the basic plan says that I am ready to start selling the stock maybe at 2x of the current price (around 450p). This equals an approximately 15x multiple over the earnings power I provided above. However, a persisting energy crisis, with Russia disconnecting from the world’s economy, and possible lasting excessive profitability for the company, would make me re-evaluate the fair price and the exit point. As I said, if I can reasonably get 5x, I won’t limit myself to a 2x.

“Reasonably” means that certain developments will have elevated the production capacity and value of the business to a level that 5x seems fair. So, it’s not about a speculative and greedy expectation of selling at the absolute top of a stock chart, but about fine tuning the outcome in an asymmetric risk-reward situation.

For example, in Enwell (ENW) (see article), I would normally act as a raging bull, and buy more of the stock after its collapse, but with the dramatic events that can potentially lead Ukraine or the company’s production facilities under Russian control, I am taking a step back. Under these developments, the only secure value is the cash staying in the balance sheet of the UK parent company.

My point is that I avoid re-evaluating a company on a per quarter frequency, but I take into account ground-breaking events that can clearly change what the company’s value and future cash flows are. This way of thinking is key for maximising the outcome in an uncertain investment.

The Hedge Value

The events in Ukraine are so sad. Let’s hope that there will be no more escalation and human suffering. On the economic side, a forced cut on Russian gas addiction could bring a lasting energy crisis in Europe, before increased supply—probably from the US (LNG & oil)— would balance the situation in a few years from now.

Buying an oil producer is like buying insurance against this type of events. The problem with hedging and insurance is that when the danger has already erupted, the price of securing yourself becomes so expensive that buying the proposition makes no economic sense. But here, things are different.

The valuations in oil and gas companies were already low due to their past weak profitability, accelerated by the pandemic, and the ESG narrative. The events in Ukraine, and the record energy prices, should have led these stocks to much higher levels.

However, so far this has not clearly occurred, probably because the buying force is counterbalanced by an index-like, and indiscriminate panic selling. Especially for Gulf Keystone, the market may have been totally inefficient, and unfair, in pricing this “hidden” small cap.

GKP stock during the previous 5 years. (Source: Google Finance)

In a few words, the energy environment has obviously become far more risky for the consumers and the economy, but buying the relevant insurance—through investing in this oil and gas equity—has not become more expensive. That’s so unique, and buying this insurance is a no-brainer, in my view.

Thus, the stock, apart from being undervalued, is a great hedge for the portfolio, protecting it from a severe energy crisis, and surprisingly in good terms. Because the Enwell story may not evolve as expected, and JKX has already been (profitably) tendered, Gulf Keystone seems to be a great addition to the portfolio. Along with Smart Sand (SND) (article), and Romgaz, it will protect me in the event of an energy crisis.

Peace to the world!

PS 1: I discovered Gulf Keystone through The Broken Leg Investing newsletter.

PS 2: If you are around London, you are very welcome to attend this meetup event on Monday (14/3/22). We will discuss about the company, energy, and more!

Dimitrios Koutsoumpos

*Content presented on Investorblog does not present any recommendation for stock transactions. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.

Ελληνικά

https://www.londonstockexchange.com/news-article/GKP/special-dividend-of-50-million/15467406

Another $50 million of dividends!

https://www.londonstockexchange.com/news-article/GKP/2022-half-year-results-announcement/15609030

Gulf Keystone announced $162 million in net profit, $177 million of cash flows in 6 months, and so far $215 million of dividends in 2022.

I bought back in January (and increased in slightly higher prices) for just (189p per share) £400 million or $466 million!

I have already got almost half of my investment back in dividends in less than a year😅.

Ok, the Kurdish Administration is under the threat of the Iraqi central government or Turkey may bomb them, or Iran. I think it is worth it when you get 50% like dividend yields!