by Dimitrios Koutsoumpos

by Dimitrios Koutsoumpos

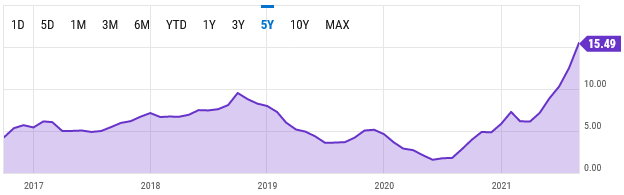

The rising gas price challenges the economies of Europe. From the very low of under $2 MMBTU, during the pandemic, the precious energy commodity has lately skyrocketed to $20 MMBTU in the European markets. The households and the industry are already paying the price, and expected to pay more, especially with a cold winter. The great beneficiaries of the situation are the gas producing nations and companies. Enwell Energy, and JKX Oil & Gas, are two Ukrainian gas producers that are enormously benefiting, but surprisingly seem to be extremely undervalued.

European Union Natural Gas Import Price (USD). (Source: YCharts)

I came across both of them through The Broken Leg Investment Letter, which screens for companies with very low valuation multiples and criteria for which research suggests that they are connected to market outperformance. What fascinates me is that these companies seem cheap even without accounting for the massive improvement expected in their profitability, amid gas record prices.

Enwell Energy

For example, Enwell trades for 139$ million market capitalization at 31.5p* per share (equivalent of 0.43$), when net cash resources are $63 million). FY 2020 profit was only $3 million, but the average selling price during the year was only $136/Mm3. For the first half of FY 21, the average selling price should come in around $230/Mm3 (by using data from JKX), and is expected to be much higher in the second half, since current prices have more than doubled.

For example, Enwell trades for 139$ million market capitalization at 31.5p* per share (equivalent of 0.43$), when net cash resources are $63 million). FY 2020 profit was only $3 million, but the average selling price during the year was only $136/Mm3. For the first half of FY 21, the average selling price should come in around $230/Mm3 (by using data from JKX), and is expected to be much higher in the second half, since current prices have more than doubled.

*Enwell’s and JKX’s reporting currency is the US Dollar ($), but both trade in Pence Sterling (GBX) – Close price, 10th September, 2021.

In FY 2018, when the average selling price was $312/Mm3, Enwell achieved an operating margin of 48% (reversal of impairment excluded). Provided that pricing conditions remain good, if we apply this margin to current production levels of (5,250 boepd), the company could report approximately operating income of about $40 million, and net income of $30 million in FY 2021.

If I am right, forward P/E could be as low as 4.5x. Also the company will have increased its net cash. I am lucky to have bought Enwell, now trading at 31.5p, at only 21.1p per share a few months ago. Back then, it was trading with a forward earnings multiple of 3x, and in Enterprise Value** terms, with a multiple of about 1x! Now the multiples are higher, but still promise significant upside potential.

**Enterprise Value: Net cash subtracted from the acquisition price.

EV = Market Capitalization – Net Cash

JKX

Similarly, JKX has net cash of $36 million and trades for $86 million, at 36.2p per share. JKX has already announced its H1 FY21 results, and a generating operating income (before exceptional items) of $11.3 million. Depending on gas prices, operating earnings might exceed $25 million this year. If my assumptions are correct, forward P/E could be, as in Enwell, in low single digits, and much lower in EV terms. Russia brings in about ⅕ of the revenue, but barely generates earnings, because the company sells in extremely low regulated prices. It would be awesome for JKX if any liberalisation took place in the country.

Similarly, JKX has net cash of $36 million and trades for $86 million, at 36.2p per share. JKX has already announced its H1 FY21 results, and a generating operating income (before exceptional items) of $11.3 million. Depending on gas prices, operating earnings might exceed $25 million this year. If my assumptions are correct, forward P/E could be, as in Enwell, in low single digits, and much lower in EV terms. Russia brings in about ⅕ of the revenue, but barely generates earnings, because the company sells in extremely low regulated prices. It would be awesome for JKX if any liberalisation took place in the country.

The Investment Case

These ridiculously low P/Es become very interesting by taking into account the large amount of cash that the two companies hold in their balance sheets, also offering some downside protection.

However, those investments are aggressive. The most profound and severe reason is that “oligarchs” control them. In Enwell, Vadym Novynskyi owns 82.65%, and, in JKX, Igor Kolomoisky, and Alexander Shnir together, control almost half of the shares. So, while these are UK based companies trading on AIM, they have operations in Ukraine, and are controlled by locals who are involved in politics. By searching on the internet, you may find scary titles for those bosses.

Also, the oil and gas sector is notorious for its boom and bust cycles. The extremely high expected earnings of FY 21 are due to favorable conditions, which won’t last for many years. Gas companies will get enthusiastic and pursue large investments to increase production. When the next downcycle comes, many of them won’t be able to recover the large capital expenditures, and will either go bust, or be forced to dilute their shareholders.

In their recent history, Enwell and JKX, have not diluted their shareholders, and have preserved cash to stay resilient in challenging periods, as they do now. This is a very crucial factor for me, because in most other oil and gas companies I come across, I notice severe dilution, which is destructive, and explains why some stocks go lower and lower through the years. The diluters always seem cheap in multiples, but actually are not. Holding them in the long run is just destructive, resembling a bottomless pit. Fortunately, JKX & Enwell have been growing through the previous few years, without issuing shares. I wouldn’t have bought them, if I had seen something different.

In addition, even with moderate natural gas prices, like the average of $230/Mm3 we saw for the first half of the year, the two gas producers should stay profitable and have a single-digit P/E. For example, in JKX, net income of $8.3 million in H1 FY 21 (before exceptional items), brings an annualized P/E just above 5x.

Also, Ukraine’s oil and gas industry seems to have interesting long-term prospects, in a low-cost country, and with Europe aiming to diversify from Russian dependency. The Ukrainian companies can sell their output at European prices, compared to US gas producers who have to sell at lower domestic prices, due to the abundance of gas, which can only escape the American continent by being converted into LNG and transferred over long distances. The cost is high and the capacity limited.

So, basically, the big risk I see in JKX & Enwell is in the ownership and the country of operation. Because of that, I would hesitate to pay a full price. But, when I can get the companies for a fraction of their potential value, I can bear the risk, due to the margin of safety, and the potential profit I might enjoy.

The markets often value companies at their cyclical peaks at P/Es higher than 10x. This is something I don’t find reasonable, but very usually happens. In such a case, I would definitely be a seller of the stocks. Based on how long the high natural gas prices persist, I would adjust the price I would exit the two investments. Roughly, I am thinking of selling some of the stocks 100% higher than here.

I own both JKX & Enwell to diversify for the risk of a controlling shareholder mistreating the minority shareholders, or for a company and its boss to be attacked by Ukraine for political reasons. Again, I cannot guarantee that I won’t hit 2 in 2 traps, due to my bad luck or poor analysis.

Because of the high risk, these two stocks are a small portion of my UK portfolio, so I can handle even total loss. I am ok with this, since the potential reward seems to be more probable and higher in value.

Would you dare buy these companies operating in Ukraine?

Dimitrios Koutsoumpos

*Content presented on Investorblog does not present any recommendation for stock transactions. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.

Ελληνικά

[…] example, in Enwell (ENW) (see article), I would normally act as a raging bull, and buy more of the stock after its collapse, but with the […]