some interesting foreign stock ideas presented on Investorblog, were taken from The Broken Leg run by Evan Bleker. We feel lucky to have him with us today to answer some questions.

Dimitrios Koutsoubos: Hi Evan, thanks for being with us today! You indeed discover and present really undervalued stocks on your sites. Will you share your secrets with us?

Evan: Hi Dimitrios! Thanks a lot for the warm introduction.

My secret really comes down to a long struggle and a bit of luck. I lost a bunch of money when I started out as an investor following a pair of investors who turned out to be more marketers than anything else. That lead to a 10 year long struggle to find a strategy that was both lucrative and viable in practice. At the end I had finally remade the money I lost but I knew my returns were terrible and did not justify the amount of work I had to put in to investing. I was going to give it all up in favor of index funds when I finally stumbled upon net net stocks and deep value investing.

Dimitrios: How did that happen?

Evan: I had read Graham’s comments on net nets when I started investing and knew how great they were as far as returns go but assumed that they didn’t exist anymore. When I saw that I was wrong, I shifted into net nets and started making huge returns (as I write this, my portfolio has returned a CAGR of around 31%). I started to read as much as I could about net net investing and really dissect the strategy to understand it as best I could.

Dimitrios: Was it always easy to find Net Net’s?

Evan: I had started to look at net nets in the USA since it’s easiest to find stocks in the US. In 2013, however, it was very tough to find good quality net nets so I was faced with a choice to either abandon the strategy or to start my website, Net Net Hunter.

Dimitrios: You must have learnt a lot through this “journey’?

Evan: There are a few core principles that I learned about when studying net nets that are universal principles in the world of deep value investing. The first is the need to start with a high performance strategy, proven through academic studies.

The second is to diversify heavily and emphasize the performance of the group rather than the performance of any individual stock.

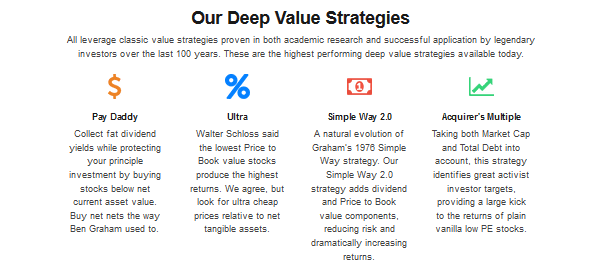

And, the third is what has been dubbed the broken leg problem, that there’s always a reason not to buy these firms but you have to ignore them because those blemishes could have nothing to do with whether the company produces a great return or not. I’ve applied these principles to other sorts of deep value strategies: Ultra stocks, The Acquirer’s Multiple, Pay Daddy net nets, and Simple Way 2.0.

Dimitrios: It’s difficult to outperform the market? Isn’t it?

Evan: Yes and no. It is difficult for stubborn people to outperform the market. A lot of people I talk to refuse to abandon their own prejudices and look at investing from a completely different point of view. They don’t adopt what works due to these prejudices and actually refuse to do the background research that would help disconfirm their beliefs.

Those who have an open & inquisitive mind find it very easy to beat the market. You simply follow an exceptional investment strategy well. You don’t have to be smarter than average, or have some sort of tallent or gift for investing. That’s a myth. You just have to apply a great strategy well and stick to it over the long term. It’s really that simple.

Dimitrios: So, how have you managed that?

Evan: I think that I have an ability to understand big picture concepts and apply them to real world investing. I stick to the strategy and apply it as best I can. I remain agnostic about any one of my picks and I trust the data. This is something that anybody can do… you just have to get the information, trust the information, and then plug your nose and buy.

Dimitrios: Can anybody implement what you do?

Evan: I don’t think that I have any unique gift that allows me to beat the market. A lot of people look at great investors and assume that they’re sort of super human. They think those investors have some sort of rare ability. Well, that may be true, but those skills and abilities are not necessary for beating the market long term. The ability to earn the types of returns that I am is open to anybody who adopts the same strategies that I have and then works at implementing them well. Of course, it helps if you also develop your emotional temperament.

John Templeton argued that if you held a tennis tournament, at the end you would have just as many winners as losers, so the average player would not come out ahead. According to Templeton, that’s no reason to stop playing, though. Beating the market is open to every day investors primarily because investing is a lot simpler than the financial industry wants you to think it is.

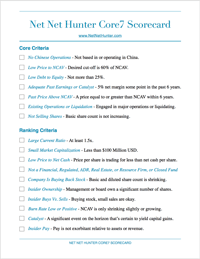

A scorecard example.

For example, we have a 12 month holding period where we hold and then check to see what’s happened to the stock after the year’s up. There’s not much at all to do in the meantime, but investors have the misconception that you should always be assessing, buying, and selling. Hyperactivity does not add any value.

Another example is the scorecards we use to assess our stocks. Most investors are trying to predict the future, trying to assess a company’s products relative to its peers, trying to really get key insight into the operations of the business. They spend weeks reading through financial statements and supporting data, then plotting out expecting earnings in order to value the firm. I haven’t seen any evidence anywhere that this adds any value whatsoever. We use simple proven criteria, such as an ultra low Price to Net Tangible Assets or share buybacks, in order to make our stock selections. These firms, statistically, perform much better than average… and they’re also easy for individual investors to use.

Dimitrios: If that’s so easy, why not everyone has become rich, by doing that?

Evan: I’ve been talking to small investors as founder of Net Net Hunter and The Broken Leg since 2013. Ironically, a lot of people have goals other than beating the market. They want to be part of some community and talk shop about stocks… maybe they want to feel comfortable with their investments rather than make good profit… others want to be seen as really smart and held in high esteem by the value community, so try to do things that are difficult. All of this is over and on top of refusing to abandon their own prejudices about investing. There’s A LOT of, what economists would call, irrationality out there. In fact, in running Net Net Hunter, I would say that its the rare individual who makes rational wealth maximizing decisions.

Dimitrios: Can you share a very successful investing example?

Evan: One of my favourite stocks of all time was a troubled solar component maker in the UK. Right off the bat we have two red flags for a lot of investors. People don’t want to invest in troubled firms or international stocks. The firm had been losing money for years and the industry was really hurting due to Chinese dumping. In fact, the company’s stock price had dropped by -78% over a two year stretch! Most people look at money losing firms and automatically think that the company must be a terrible investment. On top of that, it’s easy to think that a firm that’s suffered a -78% drop in stock price will go to $0. These are all well entrenched prejudices.

Dimitrios: Many investors believe that. Are they wrong?

Evan: Well, the data does not support those beliefs, at least when it comes to net nets. Most net nets have suffered devastating declines in price and most have lost a lot of money. To top it off, the firm was both trading at about 8 pence (0.08 GBP) per share and had a Market Cap of near 12 Million GBP. Almost all investors shy away from firms trading under $1… assuming that they’re all scams when the data really doesn’t support this. Many are, but many aren’t. Most investors are also stuck on the idea of needing to buy large cap stocks because that’s what the pros buy… all of this is insane.

Dimitrios: What other evidence showed that this stock was an opportunity?

Evan: When I looked at the company I saw a firm with a business that was struggling. I saw how depressed investors were about the industry, despite the tremendous growth of solar. I also saw that the company’s main source of value, its net current asset value, was very stable. The company also had no debt and was trading at under 30% of net current asset value. That’s a massive 70% discount to fair value.

There were also signs that better times were on the horizon for the firm. Management was conducting a strategic review to see if they should continue as a going concern or liquidate. A liquidation would have meant a large profit since I bought at a deep discount to liquidation value.

The company was also locked into some damaging contracts at really disadvantageous prices, but those contracts were coming to an end soon. It looked like there were a number of catalysts on the horizon.

Dimitrios: Finally, what was the outcome?

Evan: It didn’t take long for the stock to start climbing. As the firm’s bottom line improved, investors began jumping into the investment. By the time my 12 month holding period was up, the stock had climbed 125% and I got out. A few months later the stock reached 150%. That’s a very nice 13 or 14 month gain.

Dimitrios: This is the total opposite that the average investor would expect.

Evan: It’s very damaging financially to hang on to your prejudices despite the evidence. People do this all the time and it costs small investors billions of dollars. Failing to shake off your prejudices can cost you personally millions of dollars over the course of your life, not to mention early retirement.

http://www.netnethunter.com/pv-crystalox-lonpvcs-comes-back-dead/

Dimitrios: Evan, that example sounds great! But what if a stock fails? A lot of people lose money in the stock market and they afraid failures.

Evan: As good as PV Crystalox was, I was agnostic about the final outcome. I just didn’t know. But, I did know that the odds were in my favour so a portfolio of similar companies would produce a great return as a group. It’s always the group outcome that counts – not the outcome of individual stocks. In the process, I’m bound to have some stock picks that really dissapoint or even lose money… but that’s part of the process. It’s the group return that counts.

Dimitrios: Yes I agree, the summary counts. But why don’t people concentrate on the group outcome?

Evan: It’s a bit nutty, but investors are obsessed with avoiding disappointing stocks. This is what psychologists call narrow framing. I really couldn’t care less if one of my stocks does not advance in price or even causes me losses. This has happened a few times but my portfolio returns are still outstanding. I just try to buy stocks with the highest likelihood of producing great returns and let the chips fall where they may.

Dimitrios: What inspired Evan Bleker most for being an investor? A book, a great investor, or something else in life?

Evan: I have a fantastic uncle who got me a terrible job after I graduated high school. I was working at a fibreglass shipyard doing labour: sweeping, carrying heavy things, pushing heavy things, wiping stuff with rags… We had to wear coveralls and full resporators to protect against breathing in the fibreglass but it only provided so much protection. Little fiber glass needles would embed in our skin and we’d get nose bleeds… I had originally gotten the job to save for a new Jeep Wrangler but after 12 months, even though I had enough to buy the Jeep in cash, I knew that the truck was not worth everything I’d been through. I knew that I had to put my money to work for me instead.

Dimitrios: Haha! You are right! I also had a very hard job in sea aquaculture. I understand and I agree. So, how did you start?

Evan: That job got me into the bank talking to a financial advisor. I had taken a consumer education course in high school which looked at stocks so when I saw the fund returns she was suggesting I knew she was just trying to sell me the bank’s terrible investments. She didn’t care at all what happened to my money. That’s when I knew that I had to take investing into my own hands if I wanted to do well so I went to the book store and loaded up on investment books.

Dimitrios: Why do so many financial advisors offer bad advice?

Evan: Few people realize that the financial industry is set up to steal your money. You have financial “advisors” or “planners” who are really just sales people in disguise. My friend’s mother lost her entire life savings after an advisor told her to put all of her money into stock options. My sister-in-law’s friend lost a lot of inheritance when an advisor told her to put all of her money into oil when oil was at record highs. The same thing happened to my dad. If you have any desire for decent results at all you have to get the knowledge yourself and learn how to make wise investment decisions. It’s not rocket science… but avoiding financial predators is part of it.

Dimitrios: But you weren’t just satisfied being an investor — you wrote a book, right? You distilled the methods for others and you made two great investment sites, helping small investors to follow your example. Why did you do that?

Evan: For one, I couldn’t find decent quality net net stocks anymore in the US. There’s a lot of information about US stocks, and a lot of great resources, but as the market rose good quality net net stock opportunities began to dry up. I knew that there were net nets internationally but I couldn’t find any resources on them aside from big data providers. The only way I could continue and justify the cost & time needed to find these firms was to build a solution and then make that tool available to like-minded investors. Net Net Hunter is really a tool that I created for my own investing – it just happens to help out a couple hundred like-minded friends.

Dimitrios: That’s Net Net Hunter… but what about The Broken Leg?

Evan: What really made my blood boil was coming home to visit my family one summer and discovering that my father had been suckered into an investment plan where the advisor estimated a 4% long term growth rate and was charging him a 2% management fee for the pleasure. I was really angry. I knew that there were a lot of people that didn’t have the time or the skill needed to invest well and something needed to be done to help them. That’s why I decided to start The Broken Leg Investment Letter. By joining, people who do not have the skill or time needed to invest well can have 95% of their investing done for them. All they have to do is execute the buy and sell orders.

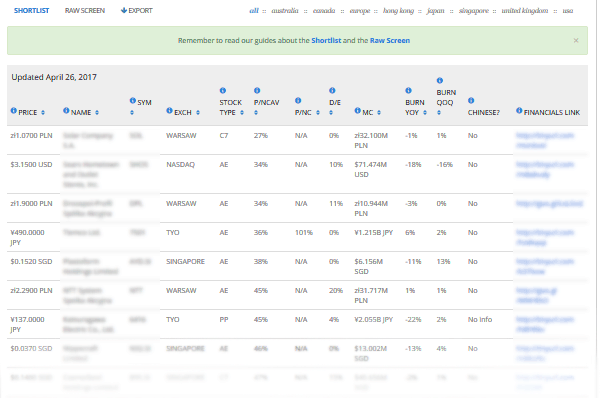

Dimitrios: Ok, can you explain in more detail how your methods work? What they look like? What can somebody get from your sites?

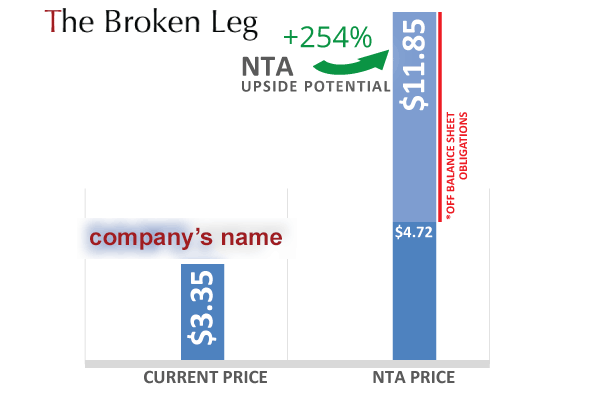

Evan: When it comes to investing, simple is beautiful. We start with a high performance value strategy which is based on some source of value, and then we add “sweeteners” to boost performance. For example, in our Ultra strategy we look for stocks trading at ultra low prices to net tangible asset value. We want to see a discount of 60% or more. Then, we look for insider buys or share buybacks which boost returns and help improve the percentage of winners in our portfolio. We have a number of well thoughtout criteria which we wrote out in The Broken Leg Ultra Scorecard, and we assess all new stocks based on that scorecard.

From there, we aim to have our readers invest 1/24th of their portfolio in each pick and then hold that pick for an entire year. 1/24th is ideal for our Investment Letter subscribers because it yields a great amount of diversity. Investors using a mechanical strategy should aim for 20 stocks or more in their portfolio, all equally weighted positions, and pegging the number at 24 allows them to get into the habit of buying 2 stocks per month. Come the end of that holding period, we then re-assess to see if the company is still a buy or whether it should be replaced with another stock..

Dimitrios: What are the differences between “The Broken Leg” and the “Net Net Hunter”?

Evan: Net Net Hunter is really built for folks who are intent on picking their own stocks for their own portfolio. They want to learn as much as they can about the strategy and save a lot of time (up to 30 hours a month) by having someone else filter through the 1000+ net net stocks available internationally to focus on the 30 or so best opportunities. Most of our members want to learn how to invest in net nets and retire early.

Dimitrios: And the Broken Leg?

Evan: The Broken Leg is for investors who lack the skill or the time needed to pick stocks for their own portfolio. Our aim is to help vulnerable investors who trust in Ben Graham & Walter Schloss but just can’t pick stocks for their own portfolio for whatever reason. We do all of the investing for them, from filtering through the 100s of thousands of stocks around the globe to highlighting a few candidates, diving deeper into those candidates, selecting the most promising to research, conducting thorough analyses of the companies based on our scorecards, and then presenting the findings to subscribers. We even walk them through a radically simplified portfolio construction process, helping them understand how to buy, how to size positions, and when to rebalance. Part of that means instilling them with key background knowledge and frameworks, such as the narrow versus broad framing concept I mentioned above.

This graph example is a part of The Broken Leg’s Newsletter, showing the upside potential of a low NTA stock.

Dimitrios: Who can subscribe? Are they suitable for experienced or novice investors? If somebody has no idea about investing?

Evan: The Broken Leg is really meant for people who don’t have the time or the skill needed to invest well. Subscribers really don’t need any investing knowledge to invest well. We walk them through everything they would need to know so they can take full advantage of the strategies and our stock picks. We also highlight new resources to read every month so that new investors can deepen their knowledge base.

Dimitrios: In Investorblog I presented some ideas, digged from you sites. One of our readers, and an investor, was excited and told me: “Ask Evan Bleker about the risks and the opportunites of Singapore!”. Will you answer him?

Evan: Sure, I’d be happy to!

Dimitrios: He will be happy to read, too!

Evan: Haha I really take a superficial look when it comes to geographic diversification in favour of just picking the best possible stocks I can almost no matter where I find them. The caveat is that I want to make sure that financial reporting and minority shareholder rights is sound in any jurisdiction before investing.

Singapore has done a lot to stamp out corruption so I think that the markets are pretty safe for investors due to that. The country is also dirt cheap at the time of writing this, at least compared to other jurisdictions. That means that it’s been a good source for net nets and some of the opportunities we’ve found have been exceptional. S i2i Ltd.’s performance over the past year is a good example of that.

Dimitrios: That said, Singapore sounds great!

Evan: It’s not a perfect place to invest, however. Government Debt to GDP is fairly high, which is a bit worrying. The thing, though, is that there’s no way for a regular investor to tell what will happen on the macro scene so it’s best to just focus on buying the best cheap stocks that you can find.

Dimitrios: So you insist on strictly following simple rules. Why is that?

Evan: This is what I would call mechanical investing. Research has shown again and again that mechanical investing formulas outperform intuitive stock pickers… and the results aren’t even close. In fact, the phenomenon of checklists outperforming human decision making is very robust throughout the social sciences and other arenas, such as in medicine and with airline pilots. It only makes sense that we take heed of this research and act accordingly. If criteria is well-selected, your portfolio is bound to see exceptional results. A lot of investors will dispute that, held hostage by their own prejudices about investing, which is fine. That just reduces the competition for the rest of us.

Dimitrios: So, by being better than the competition, what returns can we expect?

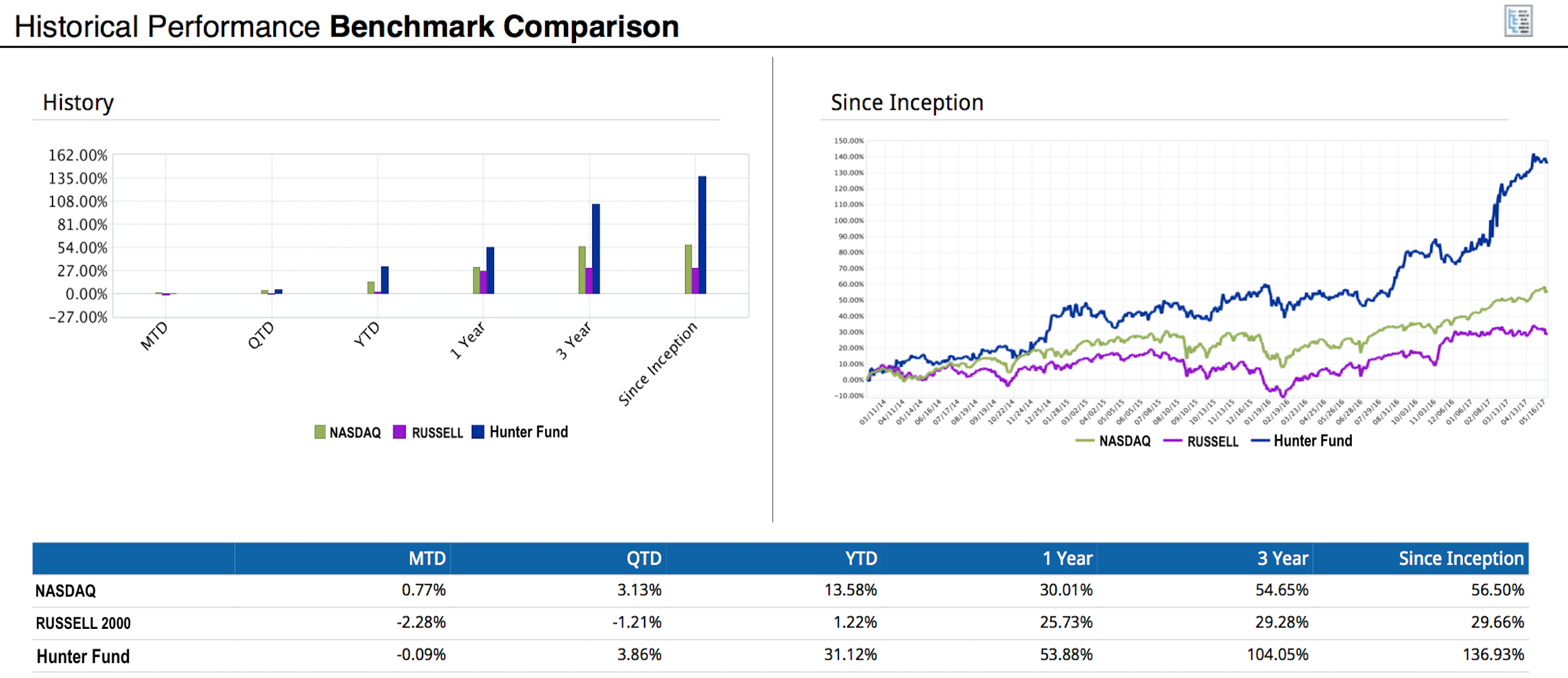

Evan: It totally depends on the strategy you employ. With net nets, studies show returns that are consistently 15% ABOVE the market return (ie. if the index returns 10%, net nets return 25%) but this can sink or rise depending on which net nets you focus on. The net nets I focus on should produce a 30% CAGR over the long term.

Evan Bleker’s Returns

With our Broken Leg Strategies, back tests have shown returns between 20 and 27% since 1999 if each strategy is followed to the letter. Our net net stock dividend strategy is really intended for investors who need income. Our aim is to allow investors to collect above average dividend yields while they back their principle investment with solid net liquid assets. A lot of investors are buying “dividend growth stocks” right now, mistakenly assuming that they’ll provide large returns. Since interest rates really determine the multiples investors are willing to pay for stocks, the question these investors have to ask is: what happens when valuations reset back to more normal levels? I would not want to be in their position.

We also took a page out of Greenbackd’s book, adopting the Acquirer’s Multiple strategy. We started with ultra low EV/EBIT and EV/EBITDA ratios as a base but build a solid scorecard by adding other great selection criteria. Studies have shown that these stocks produce returns of about 20% per year but we think this is a bit low given our additional selection criteria.

Few investors realize that Graham actually developed a solid mechanical value strategy just before his death in 1976. It’s been dubbed the Simple Way. Back testing shows returns of about double the market’s return but we’ve done our own studies enough to really evolve the strategy. We’ve dubbed this strategy Simple Way 2.0, and have seen it produce a 25% CAGR since 1999. This strategy is really for investors investing larger sums of money – over $500,000 USD.

Our Ultra strategy was inspired by Walter Schloss and closely mirrors a net net stock strategy. It’s based on Net Tangible Assets (Shareholder Equity less Intangible Assets and Goodwill) and we aim to buy tiny firms at dirt cheap prices relative to Net Tangible Assets. Incorporating our additional criteria, we’ve seen it produce returns around 27% per year since 1999.

Dimitrios: Will I nail that type of growth?

Evan: Maybe, maybe not. One thing researchers have found is what’s been dubbed “the behavioural gap”. This is the 1 or 2% drop in performance that humans experience when trying to copy a model. It’s normally due to all sorts of behavioural biases that people introduce into their own investing which end up costing them a lot of money long term. It can also be due to other factors, such as purchase timing, etc.

To do the best with these strategies you really have to follow them as best as you can. Don’t cherry pick the stocks you like, excluding the stocks you don’t like. Don’t aim to hold fewer stocks, and don’t exit the market to avoid a market drop. All of these errors can cost you a lot of missed profits long term.

Dimitrios: What do you do to stay at the highest possible CAGR?

Evan: I’m doing a lot to try to reduce the errors I make but, being human, it’s not easy. Some of the tactics I’m employing are not checking my stocks very often, focusing on set holding periods, and making fewer judgements based on intuition. I’m also looking to improve the scorecards I use so that, even if I can’t shake the behavioral gap, I can at least boost my returns long term.

Dimitrios: Very interesting Evan. So, what would be the best advice you would give to an investor?

Evan: Aside from joining Net Net Hunter or The Broken Leg, you have to find a high performance investment strategy that is backed by hard evidence in terms of academic or industry studies. From there, you really have to make sure that the strategy that you select is viable… it has to be able to be used in the real world. This is how I’ve gotten to where I am today and there’s no reason to think that you can’t do the same.

From there, dive into the strategy to learn a lot about it and make sure you’re not making mistakes that are sure to trip you up. When I started, I tiptoed into net nets with a couple of stocks to see how the strategy performed. Since the strategy depended on good diversification, I was making a serious error that could have completely derailed my investing.

I would also make sure to read a lot of the articles on Net Net Hunter because there’s a tremendous amount of value there. On that note, read through the articles on www.brokenleginvesting.com as well.

Finally, once you have a great strategy, stick to it over the long term. The inability to use a strategy consistently really destroys the chances of a lot of investors to earn great returns.

Dimitrios: Thank you very much Evan for your interesting answers

Evan: You’re very welcome, Dimitrios! I hope that your readers will find some of this valuable and take away some ideas to really improve their investing.

Evan Bleker

Evan is a private investor based in Seoul. Through careful study of value investing, statistics, and philosophy he’s been able to earn a 31% CAGR on his personal net net stock portfolio and now spends his time helping others do the same.

*Content presented on Investorblog does not present any recommendation for stock transactions. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.

Ελληνικά

TYRA RAHMA

I started to read as much as I could about net net investing and really dissect the strategy to understand it as best I could.

APRILIA KINANTHY

how to get the book?

Dimitrios Koutsoubos

Technically,

It is not difficult at all. But if you want to do it seriously you have to read a lot.

And anyway it is a long time process to master it.

The Intelligent Investor, is the classic book that better describes the concept of Value Investing – https://amzn.to/2KEoGgr